The Freedom Money® Program

The goal of the Freedom Money Program is to accumulate ten times your annual household income in assets. Reaching this goal means that, combined with Social Security, you’ll have a financial foundation to live your life as you see fit. The simple goal fo ten times assets to income is designed to remove the complexity from setting goals to achieve financial security and, instead, put the emphasis on how you get there.

Based on over 30,000 interviews, we have identified the behaviors practiced by those who achieved Freedom Money. You can learn about these behaviors through the Freedom Money app and you can score how your behaviors compare by calculating your Independence Score™ which helps your estimate your time to Freedom Money and the best path the get there.

Freedom Money Behaviors

The Freedom Money Behaviors — like steady and burst savings, attitudes towards Real Estate and Inheritances and level of interaction with professional advisors — came from what real people say worked for them.

There is no one expert behind Freedom Money. Instead, it harnesses the “wisdom of the crowd” by comparing the behaviors of people who achieved a level of freedom to those who didn’t.

Independence Score™

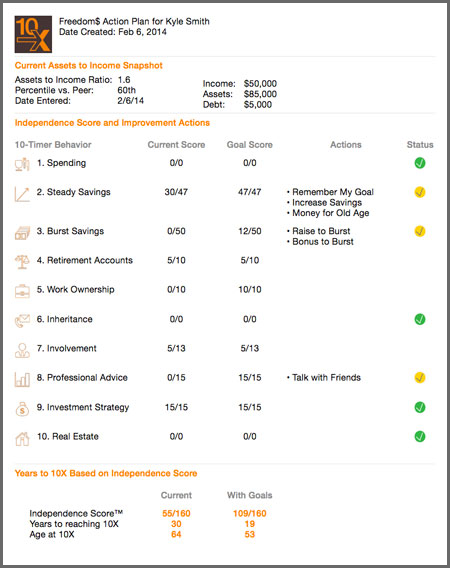

Independence Score (calculated for you by the program's questions) shows how the things you do today affect the number of years it might take to acheive Freedom Money. The score compares your current behaviors to what the research shows differentiated 10-Timers who reached Freedom Money from people who did not.

There are no value judgements in Independence Score. Higher isn’t better than lower because only you know how many years you want to take to get to Freedom Money.

Improvement Plan

At the end of the process, you'll have your Freedom Money report which shows exactly how you are doing and what actions you need to take.

The Freedom Money Tools

You can learn about these behaviors through the Freedom Money application (available both on the web and for your iPhone) and score how your behaviors compare by calculating your Independence Score. The application brings you through four key steps and then helps you maintain and adhere to your goals.

1. Calculate

Calculate your current Asset-to-Income ratio to see where you stand and compare yourself to your age cohort.

2. Learn

See about the ten bahaviors followed by those who acheived Freedom Money and calculate your Independence Score™ to estimate how long it may take you to reach Freedom Money.

3. Improve

Assess what new actions and goals may work for you to improve your Independence Score and potentially get to Freedom Money faster. If you can, set new golas for yourself over the next months and years to be tracked by the app.

4. Get Help

Get support adopting new behaviors from friends and family. Share ideas with others working towards Freedom Money.

Freedom Money Research

Freedom Money is based on moderated “wisdom of the crowd,” or empirical research into the financial habits of regular people – about 30,000 to be exact. The idea for Freedom Money came when retirement and investing researchers at Hearts and Wallets were wondering whether it was actually possible, and if so, what it took, to achieve a minimum level of financial independence without having a traditional pension plan.

Our Team

The Freedom Money Team

Laura Varas

Founder, Hearts and Wallets, LLC